Major residence need: The law helps you to exclude the benefit from your taxable income provided that the house was your primary residence (you lived in it for 2 in the five years major up towards the sale, and you did not already claim an exclusion on An additional property in the final two years).

If you decide that selling your property doesn’t make economic sense after only one year, but you continue to need to have to move, you will find other choices you can examine.

Note: Selling a next property, holiday residence, or any residence that isn’t your Major residence might make you accountable for money gains tax up to 20%. This might come into Enjoy if you opt to lease your house before you sell it, While you may take depreciation for just a rental.

Microsoft and DuckDuckGo have partnered to offer a search Answer that delivers pertinent advertisements to you though protecting your privacy. Should you click on a Microsoft-presented advert, you will be redirected on the advertiser’s landing web page through Microsoft Promoting’s platform.

Nikisha Gagne was a delightful person to operate with as I used to be a primary time customer and did know A great deal of nearly anything truly. She's so proficient and Qualified she designed The entire expertise Pleasant with out anxiety, she dealt with the many vital points ... Display a lot more

Yes, it is possible to sell a house straight away after you buy it. Normally though, it isn't a good idea. You'll likely drop cash thanks to closing expenses and funds gains taxes in the event you sell too quickly after shopping for.

The IRS does look at these guys offer several cash gains tax exemptions; nonetheless, the exclusions normally don’t use whenever you sell your house after possessing it lower than two years.

And hold an eye out for very first-month specials at your local storage unit facility — this could give you a shorter-time period place to store items at a low price.

However, Wiggs recommends checking along with your lender to discover when you’re capable to hire out your property, as they typically base your personal loan on getting operator-occupied.

Simply because your time and efforts is very important to us, we don’t preserve you hanging. Must sell your house rapid? No issue! We make identical-day gives and will near the offer as quickly as you need, in as number of as 7 days.

You might have income inquiries. Bankrate has responses. Our industry experts have been serving to you grasp your money for more than 4 a long time. We continuously attempt to provide consumers Together with the professional advice and instruments required to succeed throughout life’s monetary journey. Bankrate follows a rigid editorial plan, so that you can belief that our content is sincere and precise. Our award-successful editors and reporters develop sincere and correct articles to help you make the appropriate fiscal conclusions. The material established by our editorial staff members is objective, factual, and never motivated by our advertisers. We’re clear about how we can easily bring check that good quality written content, aggressive prices, and handy tools to you by explaining how we generate profits.

Any time a residence modifications arms, you'll find closing charges included. When you got your private home, you likely needed to buy a portion of the closing charges.

All homes are ordered within the title of the affiliated Keeping company built to obtain Attributes and may not vest during the identify of HomeGo. Typically, properties are concurrently resold as-will be to a non-affiliated entity for the financial gain. One or more of HomeGo’s proprietors, employees and affiliates may be licensed real estate property agents, salespeople, or brokers at affiliated or unaffiliated brokerages.

It is possible to typically stay away from shelling out funds gains taxes solely by residing in a house for at least two years (or two from the earlier five years) in advance of selling your see this home.

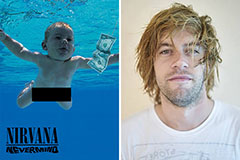

Spencer Elden Then & Now!

Spencer Elden Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!